|

| SCGM Plastic Products |

Are these products looks familiar to you? Yupe, all the things displayed are plastics. Nowadays the plastics are widely used in our life. When we go to night market to have a drink, when we go to buy eggs, or even the sandwiches, all the food are put in a plastic container. And today, we are going to talk export oriented plastic industry which benefits from low oil price. Over the weekend, i attended Grandpine Capital's event on 20 December 2015 whereby i had a chance to listen to the Chairman Dato Sri Lee Hock Seng introducing his company, SCGM.

SCGM Berhad (SCGM) was established in 1984 through its wholly-owned subsidiary, Lee Soon Seng Plastic Sdn Bhd, and is Malaysia's leading thermo-vacuum from plastic packaging manufacturer. SCGM provides end-to-end production from extrusion sheets to packaging and delivery to its customers in Malaysia and overseas, which includes Myanmar, US, Thailand, New Zealand, China, India, Hong Kong, Portugal and Australia[1][2].

|

| SCGM Plastic Products Variety |

SCGM has more than 60 well-known brands in its portfolio from various sector including food, medical, electronics and others[1]. From the pictures above, we saw these plastic products are widely used in our society nowadays, especially in the food packaging industry. SCGM has more than 5,000 different moulds in current use to form thermo-vaccuum formed plastic packaging products whereby they have the technology and the capabilities to thermo-vacuum form single layer and multilayer extrusion sheets into plastic packaging, with thickness ranging from less than 0.11mm to 2mm. These extrusion sheets are semi-raw material used in the production of thermo-vacuum formed plastic packaging.

SCGM's packaging is used to pack a variety of food products, including sandwiches, cakes, chocolates, biscuits, salads and moon cakes. Thermo-vacuum formed plastic packaging for food products should not contain any components that could migrate into the food, including harmful chemicals, contaminants and other relevant ingredients. And SCGM had been adhering to all the international standards. According to Mr Chairman, he mentioned that in order to be widely recognized, first they must adhere to the international standards, then only they can sell their products to overseas. Meanwhile, for the electronic products, SCGM is able to produce antistatic and black conductive trays to hold semi-finished electronic products, such as liquid crystal display and hard disk drive parts, as well as packaging to store end-products[2].

|

| SCGM Plant |

SCGM has a strong in-house design capabilities to customize packaging according to customers' requirements. SCGM owns the "Benxon" (as in the picture above), "TempScan", "TempScan Cover", and "Kingtex" brands, with about 52 mould designs registered under the Intellectual Property (IP) Office of Singapore and 62 mould designs registered under IP Corporation of Malaysia[1]. Currently, SCGM has a wide distribution network of 30 distributors and exports to 20 countries. As mentioned by Mr Chairman in the event yesterday, there are still a lot of markets in Malaysia, and their current ongoing strategy is to venture into Pahang.

1) Fundamental Analysis:

|

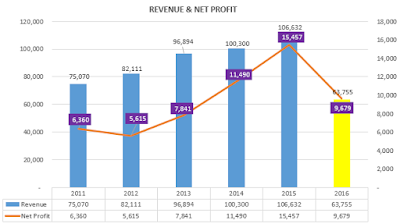

| Revenue and Net Profit for SCGM |

The revenue and net profit had been growing tremendously. The net profit margin is increasing averagely around 9.87% from 2011 to 2015. In 2016, they had announced 2 Quarterly Results. Currently, SCGM is not a net cash company as they had acquired property, plant and equipment with an aggregrate cost of RM16 mil of which RM3 mil was acquired by finance lease while the rest of the payment of RM 12 mil was paid by cash payment[2]. For me, they had been investing for company expansion with their cash reserves, which is a good news for the shareholders. The business is growing and they need to cater for the overwhelming supplies. Currently, as stated in the Annual Report 2015, SCGM had their current cash and bank balances of 90.84% in foreign currency (Australian DOLLAR-3.66%, EURO-1.94%, Japanese YEN-too minimal, Singapore DOLLAR-77.64%, US DOLLAR-16.75%, New Zealand DOLLAR-0.01%). If we look at the majority, mostly are in Singapore, US and Australia, mostly their currency are bigger than Malaysian RM at least 2 or 3 times. So, SCGM's cash reserves is widely diversified all around the world. The company is not stingy at giving out dividend every quarter. SCGM implemented a policy of paying quarterly dividends and at least 40% of anual net profit to the shareholders[6]. According to Mr Chairman, he will award the shareholder's trust through dividends. That is his only way to say thank you to the shareholders. And i like it~ A dividend of 3 sen will ex on 22 December 2015.

|

| From Petroleum by product, Resins to extrusion sheets to final products |

In the Chairman Statement, Dato Sri mentioned that aggressive marketing is actually paying off by successful penetration into Australian market. As mentioned above, they had purchased new machines with advance technologies to help to expand production capacity. More efficient machineries are continuously being developed to minimize any wastage. Their efforts to increase the revenue and net profit includes, replacing old machines with new advance automatic machinery to optimize and expand its productivity output, enhancing the skills of the staff through rigorous training program and increasing the quality in extrusion sheets and thermo forming operations. There are a few factors that contributed to the higher net profit, which are foreign exchange gain, improvement in production efficiency, lower input cost such as fuel cost and the low price of raw material (resin). And strictly, i am quite confirmed that, the factors of foreign exchange gain and raw material of resin due to lower oil price will certainly benefit SCGM. In my first paragraph, SCGM is export oriented plastic industry which benefits from low oil price.

|

| Revenue and Net Profit by Quarter |

SCGM had been actively participating in various trade shows to promote their business presence in the international stage. Their latest technology in the expanding plant facilities is expected to increase 20% in production capacity to cope with higher demand. In the Q2 Report, the revenue was higher by 15.1% compared to Q1 as the sale of new products, plastic trays and plastic cups had contributed to this Q2[3]. The profit before tax was lower by 0.01% due to the corporate exercise of bonus issue, maintenance costs to existing machinery for repairs and modifications and lower selling price to promote the new products in the initial stages[3]. 53% of the revenue is from local market while 47% is from foreign market whereby SCGM had foreign exchange gain[3]. I do like the cost spent for the adaption of old machineries to new system and the lower selling price in order to promote the products. For the future prospect, The Board of Directors mentioned that the financial results will be stable over the next 2 quarters (Q3 and Q4). Despite the challenging environment, they firmly believe that the new product, Plastic Disposable Cups will increase the Group sales. The current utilization is only 50% and the Board expects the utilization will be further improved. Let's imagine if the utilization increased to 75%, and the revenue will be RM51,177k, with Q2, RM34,118k. Let's wait whether the Board realize their talks or not.

Recently SCGM had proposed a private placement of RM2.61 on 12 November 2015 and Mr Chairman mentioned yesterday that the private placement had been completed in last week December 2015[5][6]. Now, SCGM already had spent money on the improvement of the current machineries and automation and now they will be further expanding again. The proposed utilisation of proceeds is for capital expenditure (65.48%- RM22mil for purchase of 7 machines and construction of new building), working capital (33.33%- RM11.20mil) and expenses related to private placement (1.19%- RM0.40mil). Mostly will be used for CAPEX development. It is expected that machineries will boost the production capacity for extrusion sheets and thermo-vacuum formed plastic packaging from 1.4mil kg output per month to an estimated additional output of 0.478mil kg per month. Meaning to say, the production capacity will increased from 1.4mil kg to 1.878mil kg per month, an increment of 34% per month. SCGM's plant is located on a 9-acre parcel in Johor Bahru and the company is in the negotiation to buy the 3-acres adjacent to the plant for capacity expansion for around RM3mil to RM4mil from internally generated funds[6].

Recently, Kumpulan Wang Persaraan (Diperbadankan) had been actively trading in SCGM. From September to 18 December, they had acquired 7,312k shares while disposed 575k shares, totalling up the total direct and indirect interest of 13,347,150 shares. They are slowly accumulating the shares. As in the Annual Report 2015, the fund houses had increased from 7 to 10, with the emergence of big players such as EPF, RHB-OSK Growth Focus Trust, Tokio Marine Life Insurance, Manulife Inv Progress Fund, KAF Vision Fund and etc[2]. I believe that the these fund houses are taking the opportunity during the low resin price and strong USD advantage. If we follow the current theme and their footsteps, i believe, we should be doing well also.

From the Grandpine Capital's event yesterday, just to add in some comments of my opinion towards Dato Sri Lee Hock Seng. He ventured into the plastic packaging in the early 70s that time without any knowledge. He grabbed the opportunity and therefore he is now a successful entrepreneur. He advised the audience to grab the opportunity as the opportunity only come once, which interpreted by Mr Host to buy SCGM shares. (Haha, i like it too~) From the way he spoke, he is a humble guy although he received a title of Dato Sri from Sultan Pahang. He mix well with the young Gen-Y (like me) and also mature people after the session. He bites every word clearly and sincerely, for me. He is a trustworthy person and he mentions about delivering promises after the session. I prefer a golden quote from him, “过去不代表现在”, What happens in the past does not mean it will be happening now. I left it to all of you to interpret yourself on how to change your future. That are all my personal opinions, not related to stock. Next on technical analysis.

2) Technical Analysis:

|

| SCGM daily chart |

SCGM is currently in the uptrend, with highest price of 2.97 on 18 December 2015. If you notice, i draw a golden triangle breakout and draw a green circle around it. In between the golden triangle, the Bollinger Band is getting narrower and the volume is getting lesser, that will be the best entry point. The support of 2.83 is drawn aligned with the middle band price. I also draw a resistance of 2.95. On 18 December 2015, the price had breached the resistance, but for me, i will need it to stay above the 2.95 for at least 1 week, then, only i will say that it had successfully breached my resistance of 2.95. Currently it is still "ling-a-ding-dong" - wandering around the price of 2.93 to 2.97. The RSI is looking healthy, staying below the oversold region. The MACD is looking strong with the blue line crossing over the red line. As of time of writing 11.45am, i think the volume is enough to break the new high. The chart is currently in a good shape with adequate volume to break the previous high of 2.97 and once successfully broken, then sky is the limit. From September to November, that is when the Kumpulan Wang Persaraan (Diperbadankan) is also active at accumulating SCGM price, where we see the SCGM price slowly crawling up.

3) Projection Analysis:

The Projection Analysis for SCGM is done assuming that:

1. The plant is working at the same current capacity.

2. The number of shares are the same.

Annualized EPS = 8.07 sen x 2 = 16.14 sen (let's assume 16 sen)

Current PE (21 Dec 2015) = 20.86

Target Price (TP) = 0.16 x 20.86 = 3.34 (let's round it off to 3.30)

Summary:

SCGM will be a theme play of export oriented plastic industry which benefits from low oil price.

- Export oriented earning USD and plastic is made of resin, a byproduct of petroleum processes. A combo theme.

- Aggressive marketing business is widely spread around the world and currently is actively participating in various trade shows to promote their business presence.

- Its plastic packaging is very usual in our life, from the plastic container for sandwiches, egg trays, plastic cups, etc, with plastic disposable cups are the company's latest product which had increased the revenue by 15.1% by comparing to Q1.

- Aggressive marketing business is widely spread around the world and currently is actively participating in various trade shows to promote their business presence.

- Its plastic packaging is very usual in our life, from the plastic container for sandwiches, egg trays, plastic cups, etc, with plastic disposable cups are the company's latest product which had increased the revenue by 15.1% by comparing to Q1.

- New machines purchased with advanced and efficient technologies to expand production capacity, upgrading of old machines to new automatic machines and training staffs are the steps taken by the company.

- Cash is widely spreaded in US, Singapore, Australia and other countries whose currency is stronger than RM.

- At least 40% of annual net profit are given to shareholders as dividend and the EX date of the 3 sen dividend is 22 December 2015.

- Revenue and net profit is increasing every year with higher net profit is expected in the coming quarters as SCGM had foreign exchange gain, improvement in production efficiency, lower input cost and low price of raw material (resin).

- Private Placement of RM33.60 mil had been fully subscribed with 65% allocated for CAPEX while the rest is for working capital and Private Placement expenditures, in significance to that, production capacity will increased from 1.4mil kg to 1.878mil kg per month, an increment of 34% per month.

- Efficient and trustworthy management and Board of Directors

- Recently, Kumpulan Wang Persaraan (Diperbadankan) is accumulating SCGM shares with 10 fund houses appearing in the annual report aligning with the current theme play.

- At least 40% of annual net profit are given to shareholders as dividend and the EX date of the 3 sen dividend is 22 December 2015.

- Revenue and net profit is increasing every year with higher net profit is expected in the coming quarters as SCGM had foreign exchange gain, improvement in production efficiency, lower input cost and low price of raw material (resin).

- Private Placement of RM33.60 mil had been fully subscribed with 65% allocated for CAPEX while the rest is for working capital and Private Placement expenditures, in significance to that, production capacity will increased from 1.4mil kg to 1.878mil kg per month, an increment of 34% per month.

- Efficient and trustworthy management and Board of Directors

- Recently, Kumpulan Wang Persaraan (Diperbadankan) is accumulating SCGM shares with 10 fund houses appearing in the annual report aligning with the current theme play.

- Currently uptrend with golden triangle breakout. Resistance at 2.97 and support at 2.83.

- RSI and MACD is healthy as the price is trying to go for skyhigh.

Let's Ride the Wind and Gainvest

- RSI and MACD is healthy as the price is trying to go for skyhigh.

Let's Ride the Wind and Gainvest

Gainvestor 10sai

21 Decembr 2015

1.05pm

Sources:

[1]: https://www.scgmbhd.com/

[2]: Annual Report 2015

[3]: Q1 and Q2 2016 Report

[4]: The Edge News dated 15 December 2015: http://www.theedgemarkets.com/my/article/extra-boost-scgm

[5]: http://www.bursamalaysia.com/market/listed-companies/company-announcements/4918121

[6]: http://www.theedgemarkets.com/my/article/extra-boost-scgm

[2]: Annual Report 2015

[3]: Q1 and Q2 2016 Report

[4]: The Edge News dated 15 December 2015: http://www.theedgemarkets.com/my/article/extra-boost-scgm

[5]: http://www.bursamalaysia.com/market/listed-companies/company-announcements/4918121

[6]: http://www.theedgemarkets.com/my/article/extra-boost-scgm

An interview from BLoomberg Malaysia with SCGM boss

ReplyDeleteWeak Ringgit Bonus to Plastics Manufacturer SCGM: MD

https://www.youtube.com/watch?v=1_HFWaKv8iY

Flexible plastic packaging has been the most dynamic innovation in the field of packaging. The advantages of plastic packaging are numerous. Be it moulding it into a variety of shapes or preserving the flavor and safety of food or logistical aspects, all are covered under the flexible packaging.

ReplyDeletePackaging Mastery

I recently came across your blog and have been reading along. I thought I would leave my first comment. I don't know what to say except that I have enjoyed reading. Nice blog. I will keep visiting this blog very often.

ReplyDeletewrapping machinery

Here is reference site.

ReplyDeletePackaging India

I really loved reading your thoughts, obviously you know what are you talking about! Your site is so easy to use too, I’ve bookmark it in my folder

ReplyDeletePipe Beveler

This comment has been removed by the author.

ReplyDeleteYour blog provided us with valuable & best information to your post. Thanks a lot for sharing. We have a same company also for more information click here-

ReplyDeleteFood Packaging Suppliers Singapore

Thank you for sharing such an informative blog !! Packaging Industry in India

ReplyDeleteThank you for sharing such an informative blog !! Packaging Industry in India!

ReplyDelete