VS seems like Very Solid.

The Very Solid VS seems to be under a lot of spotlight. When i browse in the i3investor, there are a lot of analysts reports on VS.[1] By judging in terms of price valuation, it is not surprising that many people or even institutions are looking at this company. VS had shot up from RM1.70 in June 2014 to RM6.40 in September 2015 (without considering the share split). So, let's put VS under our radar also.

Some background, VS is a leading integrated Electronics Manufacturing Services (EMS) provider with proven capabilities to undertake the manufacturing needs of global brand names for office and household electrical and electronic products. In fact, VS is now ranked alongside top global EMS providers – making the list into the world’s top 50 EMS providers for 7 consecutive years from 2007 to 2013. VS's subsidiary, V.S. International Group Limited is listed in Hong Kong Stock Exchange (Stock Code: 1002). VS has advanced manufacturing facilities located in Malaysia, China, Indonesia and Vietnam, who collectively employ a workforce of more than 10,000 people.[3] VS is widely recognized around the world.

Some background, VS is a leading integrated Electronics Manufacturing Services (EMS) provider with proven capabilities to undertake the manufacturing needs of global brand names for office and household electrical and electronic products. In fact, VS is now ranked alongside top global EMS providers – making the list into the world’s top 50 EMS providers for 7 consecutive years from 2007 to 2013. VS's subsidiary, V.S. International Group Limited is listed in Hong Kong Stock Exchange (Stock Code: 1002). VS has advanced manufacturing facilities located in Malaysia, China, Indonesia and Vietnam, who collectively employ a workforce of more than 10,000 people.[3] VS is widely recognized around the world.

Let's look at its business partners. From the list, i bet we know at least more than 10 companies, dealing with electric and electronics stuff, such as, vacuum cleaner, remote controllers, coffee brewers, telecommunication products, automobile plastic components, etc. [2]

1) Fundamental Analysis:

|

| *Note: 2015 data is composed from Q1 to Q3 only. |

The revenue and the net profit is growing linearly. The 2015 data is recorded without considering the Q4 result. The net profit margin is below par, as it ranges from 2.50% to 4%. As of Q3 2015, the net profit margin is 5.60%, which had shown a significant improvement if compared to previous years. Its short term debt and long term debt is increasing due to working higher capital needs.[3]

|

| Pending announcement of Q4, 2015 report. |

There is a high spike for net profit in Q4 2014 due to improved sales mix.[4] The company still suffers lower sales orders and high operating costs for Indonesia and China. [5] Malaysia has recorded a pretty amazing net profit, nearly 300% of increment if compared cumulatively from Q1 to Q3. The higher net profit from Malaysia can easily net off the loss incurred in Indonesia and China. And i expect the Q4 is going to spike up, by looking at historical Q4 results. Q4 results are normally higher if compared to other 3 quarters.

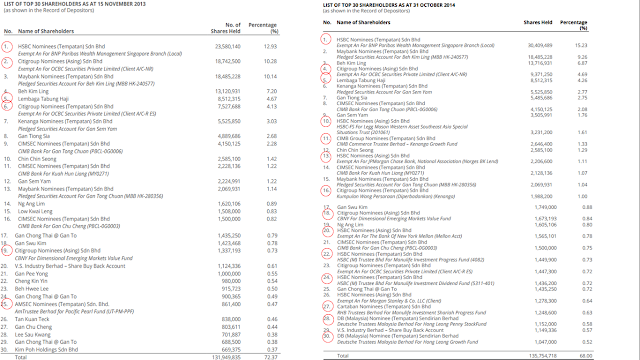

But the most striking part will be the list of top 30 shareholders in the 2013 and 2014 Annual Reports. Notice the round red balls that i draw? The big institutions are also eyeing on VS. It had increased from 6 to around 14 in 2014. Among the famous shareholders are BNP Paribas (from international company), our own very local Lembaga Tabung Haji, there are some funds as well, such as, Kenanga Growth Fund, Kumpulan Wang Persaraan, Manulife Investment Dividend Fund, Manulife Investment Shariah Progress Fund, Hong Leong Penny Stock Fund, Hong Leong Gworth Fund.[3][6] I guess this data is very crucial and at least we know what counters are the funds aiming at.

2) Technical Analysis:

VS is consistently giving out dividends for 2014 and 2015 after they announced the Q reports. A channel had been drawn connecting the higher highs and lower highs. Now VS is in a uptrend with high volumes. The momentum is still strong and will be stronger. The RSI has been in the overbought position (>70%) and the price is expected to be retraced. Look at previous overbought RSIs, when it breach more than 70%, the price will be retraced around 13% from the highest point.

VS is consistently giving out dividends for 2014 and 2015 after they announced the Q reports. A channel had been drawn connecting the higher highs and lower highs. Now VS is in a uptrend with high volumes. The momentum is still strong and will be stronger. The RSI has been in the overbought position (>70%) and the price is expected to be retraced. Look at previous overbought RSIs, when it breach more than 70%, the price will be retraced around 13% from the highest point.

The Quarter Result will be announced in this month, yupe, in September this month. Only left 3 trading days for VS. Some insiders might had known the result earlier, so, they had been buying and pushing the price up. This is a buying signal that we can take note in our future trading. Not to forget that the company had a share split of 1 to 5 on 9 September 2015. Besides the number of shares increased, the par value had decreased. This is to increase the liquidity so that people like us can join in the fun =P

Summary:

VS had proved himself in the past 2 years, it could rise 200%. The momentum is still there as it had stood up among the Electric and Electronics industry in the international stage. VS is definitely worth to monitor because of:

- Under spotlights from many research analysts and bloggers. (Please refer to their analysis as well)

- Q4 result to be announced in September 2015, based on previous year records, normally Q4 will record the highest net profit.

- Its short and long term debt is increasing, but the net gear is still healthy, around 0.5 times [3]

- Benefits from strengthening USD.

- A lot of top funds appearing in the top 30 shareholders if compared with 2013 and 2014.

- The chart now is in the overbought position, expected to be retraced.

- Be aware of downsides of FBMKLCI and volatile global economy.

Looks VERY STRONG? Your call...

Let's Ride the Wind and Gainvest

Gainvestor 10sai

27 Sept 2015

2.30am

Sources:

[1]: http://klse.i3investor.com/servlets/stk/6963.jsp

[2]: VS website, http://www.vs-i.com/

[3]: Annual Report 2014

[4]: Q4 2014 Report

[5]: Q3 2015 Report

[6]: Annual Report 2013

No comments:

Post a Comment