In my previous post, i talk about the impact of Malaysia Budget towards our FBMKLCI and also construction index. I monitor these 2 counters for past few weeks. The magic might be happening already. (Refer to my previous post on my view of Malaysia Budget 2016 towards our equity market, http://gainvestor10sai.blogspot.my/2015/10/malaysia-budget-2016-when-is-right-time.html)

Let us look at the construction index. There is a cup with handle and the breakout point at 271.42, with a resistance at 284. With the budget announcement coming, perhaps it will challenge the resistance. If the market sentiment is positive, then, it should not be a problem overtaking the 284.

|

| Construction Index |

In this post, i gonna roughly going through 2 construction counters, namely GADANG and MITRA. If our Budget 2016 is not disappointing, i think there will be another round of breakout for the construction counters.

1) Technical Analysis:

GADANG also formed a cup with handle pattern, following the construction index pattern, breakout at 1.38. The resistances are at 1.48 and 1.56 respectively. Th RSI had reached the overbought region, the retracement will be happening anytime.

MITRA also formed a cup with handle and a significant breakout at 1.06, heading towards its resistance at 1.28. MITRA is very strong lately, and its RSI is overbought at the moment, waiting to be retraced. It takes MITRA 3 months to come from the top to the bottom and to recover from the bottom to the top. What a roller coaster...

2) Fundamental Analysis:

|

| GADANG Net Profit Graph |

GADANG's market capitalization is RM339 million. Mostly construction counters are not net cash company as they need to borrow money to construct new projects and developments. GADANG is involved with construction, property, utility, plantation and investment.[3] The biggest contributing is the construction industry, while the plantation and the investment are the ones facing red. In its Q Report, the management is proposing a 5 sen dividend.[2] By looking back at the trending, the ex date will be at the last week of November. The management had been generously giving away dividends at the year end for the past 2012, 2013 and 2014.

| Snapshot from GADANG Q Report |

|

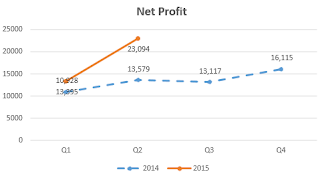

| MITRA Net Profit Graph |

MITRA's market capitalization is RM642 million, bigger by half than GADANG. Its current outstanding order book for construction stands at RM1.55 billion.[4] The healthcare division, Optimax Eye Specialist Centre, the management plans to dispose off its shareholding and is now identifying for a potential buyer. Once sold, the cash will be pumped in. The future prospects for MITRA is very convincing also.

Summary:

Riding the wind of the Malaysia Budget 2016, the construction counters should be flourishing.

- Both GADANG and MITRA forming cup with handle, which is a strong support.

- GADANG will be announcing its Q1, 2016 in this October (next week)

- 5 sen of dividends will be proposed according to the Q4, 2015 report, and ex date at the last week of November.

- MITRA's net profit is very promising, an increment of 50% comparing the cumulative results of Q1 and Q2.

- MITRA's future prospects seems convincing due to the project of LRT extension stations and also potential disposal of Optimax Eye Specialist Centre, injecting cash to the account.

- Both GADANG and MITRA forming cup with handle, which is a strong support.

- GADANG will be announcing its Q1, 2016 in this October (next week)

- 5 sen of dividends will be proposed according to the Q4, 2015 report, and ex date at the last week of November.

- MITRA's net profit is very promising, an increment of 50% comparing the cumulative results of Q1 and Q2.

- MITRA's future prospects seems convincing due to the project of LRT extension stations and also potential disposal of Optimax Eye Specialist Centre, injecting cash to the account.

- Bear in mind of the hiking material cost due to RM depreciating.

- Decide your stratehy, set your take profit point or cut loss point and be discipline.

- Decide your stratehy, set your take profit point or cut loss point and be discipline.

GADANG vs MITRA... double COMBO x2 x2

Let's Ride the Wind and Gainvest

Gainvestor 10sai

20 October 2015

12.10pm

Sources:

[1]: http://gainvestor10sai.blogspot.my/2015/10/malaysia-budget-2016-when-is-right-time.html

[2]: GADANG Q4, 2015 Report

[3]: GADANG Website: http://www.gadang.com.my/index.php?option=com_content&view=article&id=99&Itemid=107

[4]: MITRA Q2, 2015 Report

[5]: MITRA Website: http://www.mitrajaya.com.my/construction-projects.php

[2]: GADANG Q4, 2015 Report

[3]: GADANG Website: http://www.gadang.com.my/index.php?option=com_content&view=article&id=99&Itemid=107

[4]: MITRA Q2, 2015 Report

[5]: MITRA Website: http://www.mitrajaya.com.my/construction-projects.php

No comments:

Post a Comment