December month is coming. Christmas decorations and Christmas songs are just around the corner. And not to forget to go for shopping or window shopping as there are a lot of sales now~ Talking about window shopping, let's talk about window dressing activities in Malaysia. The discussions below are solely for reference. Let me remind, just a reference.

Let's take a look at our index from 2011 till now.

|

| FBMKLCI Chart |

Our index had been bullish till 2014, when the oil price drops from USD110 to USD45. As Malaysia is an oil exporter country, of course it affected our index also. The highest of our FBMKLCI is 1892.33 on 24 June 2015, now we are sideway-ing around 1600 and 1700. We had been in bull and bear market and now we are recovering slowly. I would like to show a table which shows the myth of window dressing really happens...

|

| From 2011 to 2015: Opening of the Year, the Closing of 1st Month, Last Closing of the Month and Closing of the Year |

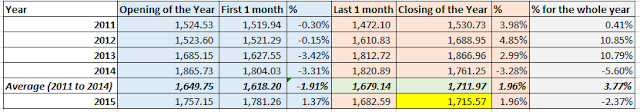

In the last 1 month of the year (November) till the closing of the year, we notice that from 2011 to 2014, the index tends to go up. The average from 2011 to 2014 is 1.96%. This is proving that windows dressing did happen. Just it did not happen last year as we did not expect the oil price to plunge. Therefore by using the average of 1.96%, we try to project the FBMKLCI will be between 1,700 to 1,750 from 27 November closing price, 1,682.59. So, what happens next? What happens after the window dressings.

From our observation, mostly the index will be retraced after the window dressing. The average from 2011 to 2014 is -1.91% but in 2015, our index become stronger after a plunge from oil price. Therefore, for 2016, after the first 1 month (January), the index might be retraced to around 1,680. Of course, these are all historical data. It will not prove anything at all. We can only anticipate and be ready.

|

| FBMKLCI can do it - NIKE |

Have a plot in the excel and it looks like this...

It forms a NIKE graph. In short, window dressing happens at the end of the year and it will be retraced in the beginning of the year. For 2015 to 2016, let's have a look at this projection and see whether it is correct or not. I think this year will be the same as previous years. Hope FBMKLCI can do it~

This week had been a very strange week. To name out a few and we, as retailers or investors should take into the consideration of a few lessons.

1. Almost all the Quarter Results are announced. Some companies announced good double or triple digit growth, the price supposed to go up, but i think the profit taking activities are too strong till they drag the price down.

Mostly investors or retailers will take profit after the Quarterly Results announced.

2. Index is going up, but the loser counters are more than the gainer counters.

Our FBMKLCI is easily manipulated. As our FBMKLCI are constituted by big 30 blue chips. By simply splashing money in them, it is enough to have a green grin FBMKLCI. Our FBMACE is having a hard time and had been in downtrend this week.

3. The foreigns are coming back. Below is the data from The Busy Weekly (Chinese) Volume 354. From the table, the foreign institutions had been net buying while the local institutions and local retailers are net sellers.

|

| From The Busy Weekly VOL354 |

Even the foreigns are pushing up our index. They are pushing the blue chips, not the ACE Markets counters. So, it is important for us to have a few moderate to expensive growing stocks, instead of keeping all the penny stocks in our portfolio.

Another assumption that i think our index will be supported is maybe the ValueCap. They might be coming in the end of November, or they are already out there.... hunting for undervalued counters~ Not much information from ValueCap, but it is worth for us to investigate.

Next, if we assume the FBMKLCI will be in uptrend, then maybe we can ride the wind of the 30 blue chips in FBMKLCI. Let's assume if we were the fund managers, what will be our direction now? Definitely, we will be avoiding Oil and Gas Counters (SKPETRO, UMW - due to low oil price), Banking Sectors (PBB, AMBANK, CIMB, MAYBANK - due to GST and low market sentiment) and RM Weakening Counters (IOICORP, TM - due to majority of debts are in USD). But one thing to note, if window dressing happens, definitely some other counters will be affected and perform. Just we need to have some time to dig out the potential uprising counters.

Please allow me to do a small advertisement...

If you like my way of analysis and you haven't join me in my facebook, appreciate if you could like my FB page, https://www.facebook.com/gainvestor10sai/?fref=ts

Thank you^^

Chances are out there waiting for us to grab. Let's create our own openings to grab these chances.

Let's Ride the Wind and Gainvest

Gainvestor 10sai

27 November 2015

11.59pm

Sources:

[1]: The Busy Weekly VOL 354

No comments:

Post a Comment