POHUAT continues to POP HUAT with the Q4 result. You can refer to my first post on POHUAT posted on 29 November 2015, with the link, http://gainvestor10sai.blogspot.my/2015/11/pohuat-pop-huat.html

1. Fundamental Analysis:

|

| POHUAT Q4 2015 Result |

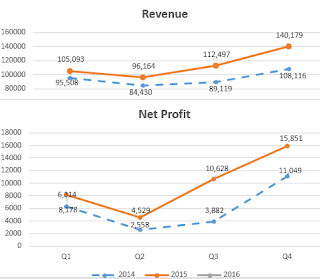

POHUAT's Q4 result had increased 43%, comparing with 2014 Q4 RM11,049k and 2015 Q4, RM15,851k. The revenue for Q4 increased 30%, from RM108,116k to RM140,179k.

The revenue and net profit had been increasing 20% and 65% consistently from 2014 to 2015. POHUAT was picked due to its growing business in US and Canada, as well as the strengthening USD against RM. And the result was proving that the pick of POHUAT is correct. The revenue mostly generated in Vietnam (67%), Malaysia (33%) and South Africa (1%). If compared to 2014, Vietnam and Malaysia had increased by 29% and 7% respectively. Do remember that there is a fire incident on 24 August 2015 which i will talk about it later.

Vietnam is manufacturing home furniture for US market while Malaysia is manufacturing office furniture for Canada market. The revenue increased in Malaysia and Vietnam signifies that the demand for US and Canada market had increased[1]. If compared to 2014, the higher gross margin is mainly attributable by the higher level of production, improvements in margin of the products shipped, particularly those from Malaysian factories and the higher proceeds realised from the stronger US Dollar denominated sales. POHUAT's current net cash is RM37,458k, with the net cash per share of RM0.1755 (2014: RM0.1756) Net cash had doubled up while the shares had been doubled up as well. In my opinion, POHUAT is doing very good already.

The fire incident on 23 August 2015, the net book value of the damages amounted to around RM9.01 mil in total[1]. POHUAT submitted a fire claim of USD3.62 mil (equivalent to RM15.57 mil) to the insurance company. As of the latest QR, the final outcome of the claim is still pending finalization. The adjusters had proposed an interim payment of VND22 bil (equivalent to RM3.83 mil) for the fire damage claim which POHUAT had received in 2 portions, first portion on 11 December and second portion on 23 December 2015, amounting to RM3.83 mil[4]. In the Quarterly Reoprt, the management mentioned that the profit before tax would have been doubled to RM52.55 mil if not for the fire incident. Because of the fire incident, the profit before tax is now RM47.37 mil. The fire incident reap in a net asset loss of RM5.18 mil, imagine in the next quarter, the profit before tax will be higher by at least RM5 mil because there is no more fire incident. Forex gain was higher in 2015 with RM12.53 mil compared to 2014, which was RM1.92mil. The management also highlighted that the consistent operational improvements in Malaysian operations had resulted in a 3-fold increased in profit before tax.

|

| Revenue and Net Profit by Quarter |

In the seasonal or cyclical factors, the management did mentioned that the principal business operations historically had shown moderate seasonality, where the production and sales of furniture are generally lower in the beginning of the calendar year (Q1 2016 - November to January) due to the local festive period as well as the summer holiday (Q2 2016 - February - April) in the middle of the year. Thus, i feel that the management is hinting that the Q1 and Q2 will be lower. So, i check through the Quarter's revenue and net profits. The Q1 and Q2 are normally lower for the previous 2 years. And i think the history will repeat again. A surge will be happening in Q3 and Q4. But due to the forex gain, i am definitely firm that the Q1 and Q2 for 2016 will be higher than 2015.

As for the prospect for the current financial year, POHUAT expect US to continue to outperform its rich-nation peers. The US economy continues to register growth in employment, manufacturing outputs, housing and corporate earnings. Due to higher employment, low mortgage rates and higher disposal income augur well for the US housing market and spending on household items, the furniture stocks are expected to flourish in the near terms. I totally agree as it aligned with previous write up. When people had more cash, they will be spending in the furnitures. POHUAT management is optimistic that the demand for the products will be sustained for the next financial year, considering the good fundamentals and strength in the North America markets and the recovering US economy.

2. Technical Analysis:

|

| POHUAT daily chart |

As for the technical chart, POHUAT had broken its historical new high, with a resistance now at 2.11. The support was drawn at 2.02 as there is a gap up. The MACD is still bullish. I expect there will be some profit taking activities to happen. Well, the decision is up to you. The reason you buy will be the reason you sell. For example, if you are buying because of weakening RM, then you can continue to hold. Overall, i still think POHUAT is still healthy to be hold, as the RM is still weak if compared to 2015. Another plus point is because of the recovering US economy.

3. Projection Analysis:

My short term TP of 2.00 had reached but there are a few reasons for me to still hold POHUAT. =The EPS for 2015 is 0.1836 with the PE 11.86 (as of 31 Dec 2015). The reasonable price should be 2.18. Assuming the PE is 15, the target price should be 2.754. Therefore, my mid term target price will be around 2.50, by taking the average of above target prices.

Since the industry is a lot influenced by forex gain, let's do a simple analysis on the forex gain with my excel table below.

From left to right columns, I consider the average USD/RM of 3 months for POHUAT, the average EPS and average net profit, for 2014 and 2015. The last column is the changes in terms of percentage, whether in improvement or decline. In short, the average USD/RM increased from 3.15 to 3.76 (19%). The increment of 19% had already boosted the EPS to 64% and net profit to 81%. Let's imagine if for the whole 2016, our USD/RM sticks to above 4.20. From average USD/RM of 3.76 in 2015, to 4.20 in 2016, the increment is around 11.7%. The EPS and net profit projected to be around increment of 40%. But as the company is still in the growing mode, i think the EPS and net profit will be more than 40%, i will take 50% as my basis.

EPS for 2015 is 0.1836, with increment of 50%, my projected EPS for 2016 is 0.2754.

So, when

PE = 10, Target Price (TP) = 2.75

PE = 12, Target Price (TP) = 3.30

PE = 15, Target Price (TP) = 4.13

This is just a rough calculation. My rough calculation of 2.75 is close enough to the 2.50 mentioned above. Bear in mind that, the target prices are just estimation and projection. Be mindful of the forex change also.

|

| The impact of USD/RM and its effect on the EPS and Net Profit of POHUAT[5] |

From left to right columns, I consider the average USD/RM of 3 months for POHUAT, the average EPS and average net profit, for 2014 and 2015. The last column is the changes in terms of percentage, whether in improvement or decline. In short, the average USD/RM increased from 3.15 to 3.76 (19%). The increment of 19% had already boosted the EPS to 64% and net profit to 81%. Let's imagine if for the whole 2016, our USD/RM sticks to above 4.20. From average USD/RM of 3.76 in 2015, to 4.20 in 2016, the increment is around 11.7%. The EPS and net profit projected to be around increment of 40%. But as the company is still in the growing mode, i think the EPS and net profit will be more than 40%, i will take 50% as my basis.

EPS for 2015 is 0.1836, with increment of 50%, my projected EPS for 2016 is 0.2754.

So, when

PE = 10, Target Price (TP) = 2.75

PE = 12, Target Price (TP) = 3.30

PE = 15, Target Price (TP) = 4.13

This is just a rough calculation. My rough calculation of 2.75 is close enough to the 2.50 mentioned above. Bear in mind that, the target prices are just estimation and projection. Be mindful of the forex change also.

Summary:

I do think POHUAT will continue to POP and bring HUAT in 2016, riding the wind of exporting strengthening USD.

- Revenue increased by 20% while net profit increased by 65% yoy.

- Demand of home furnitures and office furnitures are expected to be high in 2016, with recovering US markets and higher demands from Canada, both will benefit Vietnam and Malaysia factories.

- Submitted a fire incident claim amounting to RM15.57 mil. As of 23 December, they had received 2 portions amounting to RM3.83 mil. Because of the fire incident, the profit before tax is lowered by 9.85%.

- Net cash company with net cash per share of RM0.1755.

- POHUAT is a seasonal counter with Q1 and Q2 are normally lower than Q3 and Q4. But management are still optimistic and confident on the growth of the company.

- Immediate support and resistance at 2.02 and 2.11 respectively.

- Broke historical new high and now aiming higher. If break the resistance, then sky is the limit.

- Profit taking activities might happen on Monday. But stick to the reason of why we buy, and the reason we sell should be the reason we buy.

- A simple analysis done on the USD/RM, average for 2014 is 3.15 and average for 2015 is 3.76. The average EPS increased by 64%. Expected 2016 to harvest a good forex gain if USD continues to stay strong.

- Considering the case without the fire incident, forex claim and the growing business, the TP of 2.50 to 3.00 seems achievable in another 1 year time.

- Respect the cut loss point very much during these volatile weeks.

- Revenue increased by 20% while net profit increased by 65% yoy.

- Demand of home furnitures and office furnitures are expected to be high in 2016, with recovering US markets and higher demands from Canada, both will benefit Vietnam and Malaysia factories.

- Submitted a fire incident claim amounting to RM15.57 mil. As of 23 December, they had received 2 portions amounting to RM3.83 mil. Because of the fire incident, the profit before tax is lowered by 9.85%.

- Net cash company with net cash per share of RM0.1755.

- POHUAT is a seasonal counter with Q1 and Q2 are normally lower than Q3 and Q4. But management are still optimistic and confident on the growth of the company.

- Immediate support and resistance at 2.02 and 2.11 respectively.

- Broke historical new high and now aiming higher. If break the resistance, then sky is the limit.

- Profit taking activities might happen on Monday. But stick to the reason of why we buy, and the reason we sell should be the reason we buy.

- A simple analysis done on the USD/RM, average for 2014 is 3.15 and average for 2015 is 3.76. The average EPS increased by 64%. Expected 2016 to harvest a good forex gain if USD continues to stay strong.

- Considering the case without the fire incident, forex claim and the growing business, the TP of 2.50 to 3.00 seems achievable in another 1 year time.

- Respect the cut loss point very much during these volatile weeks.

Let's Ride the Wind and Gainvest

Gainvestor 10sai

2 January 2015

11.40am

Sources:

[1]: http://gainvestor10sai.blogspot.my/2015/11/pohuat-pop-huat.html

[2]: Q4 2015 Report

[3]: http://www.bursamalaysia.com/market/listed-companies/company-announcements/4964233

[4]: Fire Incident: http://www.bursamalaysia.com/market/listed-companies/company-announcements/4959761

[2]: Q4 2015 Report

[3]: http://www.bursamalaysia.com/market/listed-companies/company-announcements/4964233

[4]: Fire Incident: http://www.bursamalaysia.com/market/listed-companies/company-announcements/4959761

[5]: http://www.x-rates.com/average/?from=USD&to=MYR&amount=1&year=2013

Hi, Trading Advisor. Mind to show or justify on why the levels of 1670 and 1650 are important? Just want to get the logic behind. Thank you.

ReplyDeleteHi This is fantastic and is a legitimate good post . I think it will assist me a lot inside the related stuff and is significantly useful for me.Wonderfully written I appreciate & must say good job..

ReplyDeletecubicles ft lauderdale

ReplyDeletethe Pokemon Go Hacks is the one of the best ios,android App tutuapp free store to get thetons of free app and game. Panda helper apk Here the latest version of TutuApp of free.

Wow amazing app, you can try this app EVE Echoes Mod Apk

ReplyDeleteThe Tutu app is one of the best app stores where you” ll get all the things for the best mode app. There are many Spotify++ iOS multiple apps available in this field but this is the head of PokeGo++ all the apps. In the world of apps if you download only one app which gives you all the things if you open it then it’s the best option.

ReplyDelete