Poh Huat Group had more than 30 years of manufacturing excellence. POHUAT is one of the most progressive furniture producers in South East Asia

[1]. Having 3 subsidiaries (Poh Huat Furniture Industries (M), SB, PHW Properties SB, Poh Huat International SB) in Malaysia, 1 subsidiary (Poh Huat Furniture Industries Vietnam Joint Stock Company) in Vietnam, 1 subsidiary (Poh Huat International (BVI) Limited) in British Virdin Islands, 1 subsidiary (Contempro Furniture (Qingdao) Co. Ltd.) in China and 1 subsidiary (Poh Huat International Furniture S.A. (Proprietary) Limited) in South Africa, POHUAT's major activities are manufacturing, trading and sale of furniture and wooden household furniture

[3].

|

| POHUAT's Home and Office Furniture [1] |

To highlight the most contributing subsidiaries, Poh Huat Furniture Industries (M) Sdn Bhd, mostly manufacturing office furniture, exporting to North US and Canada together with Poh Huat Furniture Industries Vietnam Joint Stock Company, mostly manufacturing home furniture with North US as their biggest market

[3]. POHUAT's products are marketed under the brand name of

AT Office System and AT Home System, with acceptance in more than 60 countries in 5 continents. With their current facilities, POHUAT strive to be a "Furniture One Stop Center", to cater the ever growing demand for customers to develop a furniture collection. Being involved in local organizations such as MTIB (Malayian Timber Industry Board), MITI (Ministry of International Trade and Industry), MFA (Muar Furniture Association) and MFIC( Malaysian Furniture Industry Council), POHUAT is closely working together with the associations and had gained global recognition and international standards.

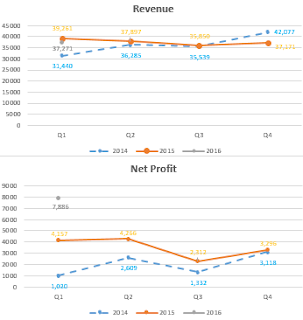

The reason why i was attracted to POHUAT is because

all the furniture exported stocks, LATITUDE, HEVEA and LIIHEN

released a double digit net profit in November. So next, i look the furniture companies that will be announcing their results in December. If they are going to announce good results, at least i will see advance movement prior to the result being announced. So, POHUAT met my criteria by releasing the

Q Result in December and i am even more excited when they are

announcing Q4 Results. POHUAT is ranked number 4 in terms of market cap and the PE looks nice. So, lets study the fundamental of POHUAT.

|

| Comparison among furniture peers |

Poh Huat Group had more than 30 years of manufacturing excellence. POHUAT is one of the most progressive furniture producers in South East Asia[1]. Having 3 subsidiaries (Poh Huat Furniture Industries (M), SB, PHW Properties SB, Poh Huat International SB) in Malaysia, 1 subsidiary (Poh Huat Furniture Industries Vietnam Joint Stock Company) in Vietnam, 1 subsidiary (Poh Huat International (BVI) Limited) in British Virdin Islands, 1 subsidiary (Contempro Furniture (Qingdao) Co. Ltd.) in China and 1 subsidiary (Poh Huat International Furniture S.A. (Proprietary) Limited) in South Africa, POHUAT's major activities are manufacturing, trading and sale of furniture and wooden household furniture[3].

Poh Huat Group had more than 30 years of manufacturing excellence. POHUAT is one of the most progressive furniture producers in South East Asia[1]. Having 3 subsidiaries (Poh Huat Furniture Industries (M), SB, PHW Properties SB, Poh Huat International SB) in Malaysia, 1 subsidiary (Poh Huat Furniture Industries Vietnam Joint Stock Company) in Vietnam, 1 subsidiary (Poh Huat International (BVI) Limited) in British Virdin Islands, 1 subsidiary (Contempro Furniture (Qingdao) Co. Ltd.) in China and 1 subsidiary (Poh Huat International Furniture S.A. (Proprietary) Limited) in South Africa, POHUAT's major activities are manufacturing, trading and sale of furniture and wooden household furniture[3].