HEXZA announced their 2016 Q1 Result on 19 November 2015.

1) Fundamental Analysis:

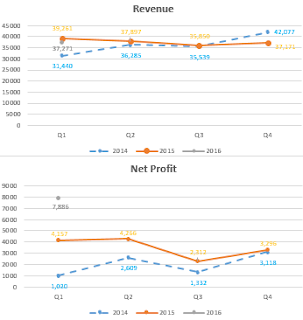

The Revenue dropped 5% while Net Profit increased 90%. (I personally will favour double digit growth, because from what i observe, normally the price will have some reaction in the next day. You can also take note of this.) For revenue, in 2014, 2015 and 2016, the average is around RM35 Mil. But as for net profit, it keeps on breaking new high. So now, lets dig into the operating segments of the business. Why the net profit increased so much while the revenue maintain?

|

| HEXZA Q1 Result [2] |

|

| Q1 till Q4 of 2014, 2015 and 2016 |

By breaking down the operating segments of the business, there are manufacturing, investing, trading and others, we can see in a clearer picture[2]. The numbers below are all profit before tax.

|

| Profit Before Tax for Operating Business Segment Comparing the Same Quarter |

For Manufacturing Segment, it decreases 50% as the operation of its subsidiary (Norschem Resin) had been ceased in August 2015. As mentioned in the Annual Report 2015 and in my previous post[3], Norschem Resin Sdn Bhd (NRSB) had been incurring losses for years and their efforts to turnaround NRSB was not paying off, and also due to the formaldehyde resins industry in Semanjung Malaysia is highly competitive, the management had decided to discontinue the business operations of NRSB on 31 August 2015. And please note that, as per in the Annual Report 2015, NRSB had entered into a S&P Agreement with Crystal Dignity (M) Sdn Bhd, to sell off its leasehold industrial land and buildings for a fee of RM17.0 million. In the latest quarter result and Bursa announcement, there is still no update regarding on this matter. I am just assuming that if they manage to sell off the buildings, another estimated of RM17.9 million will be pumped in. And the shareholders might have special dividend upon selling off of their assets. Next, here is a turnover of 13% for ethanol division by Chemical Industries Malaya Sdn Bhd. (CIM).

For Investment Segment, it had increased a wow-ing 1156% due to commencement of the lease income and unrealized foreign exchange gain. Still remember how we calculate the lease amount? The leasing quarter profit of US390,615 will be pumped in exactly in this Quarterly Result, Q1 of 2016[3]. Assuming we are using the exchange rate of 4.3, the foreign exchange gain will be around RM1.68 Mil. There are other some foreign exchange gain which are not disclosed in the report.

For Trading Segment, it decreased 92% due to the cessation of trading ethanol production in 1 April 2015.

Okay, now coming to my concerns. With HEXZA ceasing their subsidiaries operations, how can they sustain their business? How are they going to make money now? But, after looking back at the annual report, it wiped away my concerns. In the Annual Report, HEXZA had acquired new subsidiaries, take note of the pre-operating activities, NC Management Services SB, Norse-Med Devices SB and Norschem Polymer SB. We still do not know what are the principal activities of these subsidiaries and how they will contribute to the net profit of the HEXZA. But i am sure that they will create fireworks in the business model. Looking at the terms such as polymer, formaldehyde, they are the by-products of the petroleum. When the oil prices are low, their money spent on the raw material (petroleum byproducts) are lesser. And moreover, if that particular subsidiary is not making any money or loss, why should they be maintained? Might as well close the operation and work on something new.

|

| HEXZA's subsidiary companies in Malaysia as of Annual Report 2015 [1] *Note the Norsechem Resins had ceased their operations. |

Next, we go through their prospects in the Q Report.

|

| Prospects from HEXZA management |

The weakening of the RM against US will be slowing their business as it pose a threat to their raw material. But i am thinking since some of their subsidiaries are not operating, their revenue will drop and they will be less exposed to the foreign exchange loss. Closure of loss making subsidiary operation and commencement of the lease income will definitely boost up the investment segment and also weakening of RM against US will be favourable to HEXZA. So for me, HEXZA management always prepare an umbrella before it rains.

Higher raw material cost? No worries, they close down their loss making subsidiaries and lesser raw material needed

Cease operations or business? No worries, they have new subsidiaries coming in.

Cease operations or business? No worries, they have new subsidiaries coming in.

Weakening RM against USD? No worries, they have leasing profit in USD, if converted to RM will be favourable.

So thats why i like the way the management plans... 100 likes for them~

2) Technical Analysis:

In the daily chart, last week Friday, once the result being announced on Thursday, the chart gaps up to the highest 1.02 and then closes at 0.985. It forms a shooting star and the chart had flew outside of the Bollinger Band. RSI indicated more than 70% overbought, but not overbought enough. Maybe the price will be retraced on Monday. Personally for me, this is a normal situation, profit taking activities will happen after the company announces results. Especially with good results, it will spiked up and followed by profit taking, thus drag down the candle.

Normally when a stock breaks a historical new high, the chart will be retraced. Just look at the giants, such as INARI or MYEG. A Chinese Proveb saying that, resting is because of longer journey ahead. The chart also needs to take a breather in order to break another historical high and maintain at high momentum.

|

| HEXZA Weekly Chart |

As for weekly chart, it is still riding on the uptrend channel. The MACD is still looking bullish and might looking to break new high. Weekly chart is not a shooting star, because the tail must be at least double the size of the candle. But do notice of the high volume. Everytime there is a volume spike, next week, there will be selling pressure in the following week. The candle will retrace around 1/3 or full retracement and back to normal. So i expect next week, the price will be retraced. Not to forget the dividend will be ex on 24 November 2015, in order to be entitled for the dividend, the last day for us to buy will be on 23 November 2015.

Coming back to what should i do now if i am holding HEXZA shares? Well, there are a few things that you should consider.

1. The reason you sell is the reason you buy.

If you are targeting the Quarterly Result, then you can consider to sell off your shares. If you are aiming for the dividend, then you can keep the stock. If you are aiming for a possible special dividend (after the selling of the land), then, you can keep. If you see future growth when the subsidiaries are operating due to the low oil price and low raw material, then you can keep.

2. Do you want the dividend of RM0.045?

The ex date for the dividend is on 24 November 2015. So, if you want the dividend, the last day will be 23 November 2015. On the ex day, the price will be adjusted. For example, assuming the closing on 23 November is RM1.00, therefore the opening price on 24 November will be (1.00 - 0.045) 0.955. If your buying price is below the adjusted price, then, you can continue to hold as i saw a strong support at 0.94. The Dividend Yield (DY) for this stock is higher (4.7%) than our Malaysia FD rates (averagely 4.0%)

Again, you are the one making all the choices and decisions. Have your own thoughts on that and do not be influenced by others. Stick to your own plan.

1. The reason you sell is the reason you buy.

If you are targeting the Quarterly Result, then you can consider to sell off your shares. If you are aiming for the dividend, then you can keep the stock. If you are aiming for a possible special dividend (after the selling of the land), then, you can keep. If you see future growth when the subsidiaries are operating due to the low oil price and low raw material, then you can keep.

2. Do you want the dividend of RM0.045?

The ex date for the dividend is on 24 November 2015. So, if you want the dividend, the last day will be 23 November 2015. On the ex day, the price will be adjusted. For example, assuming the closing on 23 November is RM1.00, therefore the opening price on 24 November will be (1.00 - 0.045) 0.955. If your buying price is below the adjusted price, then, you can continue to hold as i saw a strong support at 0.94. The Dividend Yield (DY) for this stock is higher (4.7%) than our Malaysia FD rates (averagely 4.0%)

Again, you are the one making all the choices and decisions. Have your own thoughts on that and do not be influenced by others. Stick to your own plan.

Summary:

HEXZA still got a lot of hidden surprises (especially with the selling of Norschem Resins, new subsidiaries) and i hope one by one will be surfaced out. Particularly i like the net cash and also efficient management.

- Revenue and Net Profit for Manufacturing Segment is lesser as they cease the operation of Norschem Resins SB, thus less exposure of strengthening USD towards RM due to lesser raw materials required.

- The discontinuation the NRSB is currently still in the negotiation phase with Crystal Dignity to dispose off the asset amounting to RM17 million. Just an early guess, shareholders might receive special dividend.

- For Investment Segment, the commencement of leasing denominated in USD is favourable to HEXZA.

- New subsidiaries had been spotted in the Annual Report 2015 and the day of operations are were not mentioned.

- The lower crude oil price might be beneficial for HEXZA as their raw materials are mostly petroleum by-products.

- The management is efficient and effective in identifying the root cause of the problems and solving the problems.

- High Dividend Yield (4.70%) higher than FD, with the dividend of 4.5 sen ex on 24 November 2015.

- Ex date for dividend is on 24 November 2015.

- Chart had broke historical new high and will take a breather to challenge even further

- Strong support at 0.94 and will continue to go further

- The discontinuation the NRSB is currently still in the negotiation phase with Crystal Dignity to dispose off the asset amounting to RM17 million. Just an early guess, shareholders might receive special dividend.

- For Investment Segment, the commencement of leasing denominated in USD is favourable to HEXZA.

- New subsidiaries had been spotted in the Annual Report 2015 and the day of operations are were not mentioned.

- The lower crude oil price might be beneficial for HEXZA as their raw materials are mostly petroleum by-products.

- The management is efficient and effective in identifying the root cause of the problems and solving the problems.

- High Dividend Yield (4.70%) higher than FD, with the dividend of 4.5 sen ex on 24 November 2015.

- Ex date for dividend is on 24 November 2015.

- Chart had broke historical new high and will take a breather to challenge even further

- Strong support at 0.94 and will continue to go further

Let's Ride the Wind and Gainvest

Gainvestor 10sai

23 November 2015

9.00am

Sources:

[1]: Annual Report 2015

[2]: Q1 2016 Report

[3]: http://gainvestor10sai.blogspot.my/2015/11/hexza-chemical-solution.html

[2]: Q1 2016 Report

[3]: http://gainvestor10sai.blogspot.my/2015/11/hexza-chemical-solution.html

No comments:

Post a Comment